2025-07-15 (Tue) Market close

this is generated by AI via multiple sources, please treat this botcast as educational & entertainment purpose

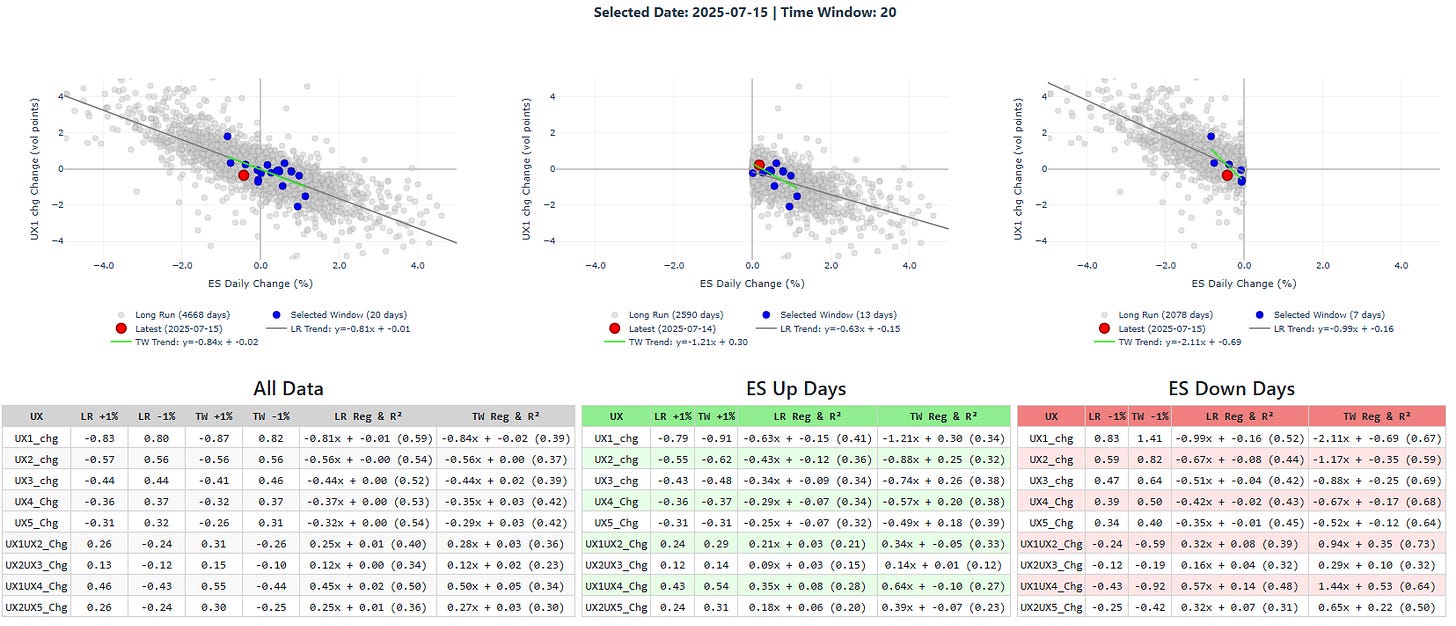

With slightly higher CPI than expected, chances of cutting rate in in Q3 was reduced. Market took a pull back (except a brief uptick news in NVDA. VIX premium is seemed built in at 19 (Aug).. but still very jitter to push up higher post Jul expiry (given low VVIX and VIX/VIX3M)

Source: Finviz

The overall market sentiment for July 15, 2025, is mixed to negative, primarily influenced by persistent inflation concerns and a mixed bag of corporate earnings. While the Nasdaq Composite experienced a record close, driven by tech strength, both the Dow Jones Industrial Average and the S&P 500 closed lower.

A. Key Market Movements and Trends

Major Index Performance:Dow Jones Industrial Average: Fell 436.36 points, or 0.98%, closing at 44,023.29.

S&P 500: Declined 0.4%, closing at 6,243.76, after easing from an earlier record high.

NASDAQ Composite: Gained 0.18%, achieving a second-straight record close of 20,677.80. This was largely "aided by a 4% rise in Nvidia shares".

Sectoral Performance:

Financials: Experienced a slump due to mixed quarterly earnings from major Wall Street banks. JPMorgan Chase, Wells Fargo, and BlackRock all saw their shares fall, while Citigroup bucked the trend with a gain.

Technology: Showed resilience, particularly with Nvidia's significant surge.

Individual Stock Highlights:Nvidia (NASDAQ:NVDA): Rose more than 4% after announcing it would "resume the sales of its H20 chip in China, and also announced a new graphical processing unit for Chinese markets." The company stated, "The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon."

JPMorgan Chase (NYSE:JPM): Shares fell despite exceeding second-quarter earnings expectations, driven by strong trading and investment banking revenue.

Wells Fargo (NYSE:WFC): Stock declined over 5% after the lender "cut its expectation for annual interest income," despite beating earnings.

BlackRock (NYSE:BLK): Dropped nearly 6% due to a quarterly revenue miss, despite "assets under management rising to a record $12.53 trillion". CEO Larry Fink expressed confidence in the company, stating, "Long term, I'm a huge buyer of BlackRock at these prices."

Citigroup (NYSE:C): Rose over 3% after topping second-quarter estimates with strong banking and trading revenues.

The Trade Desk (NASDAQ:TTD): Surged 14% following the announcement that it will join the S&P 500.

MP Materials (NYSE:MP): Jumped over 25% on a $500 million deal to supply Apple with rare earth magnets.

DoorDash (NYSE:DASH): Fell nearly 2% after Jefferies downgraded the stock to "hold" from "buy", citing its recent outperformance and valuation.

Southwest Airlines (NYSE:LUV): Downgraded to "in line" from "outperform" by Evercore ISI, with shares trading lower.

First Solar (NASDAQ:FSLR): Popped 6% on news of a Section 232 investigation into polysilicon imports, a potential precursor to tariffs.

Newmont (NYSE:NEM): Dropped 8% after its CFO departed.

Tesla (NASDAQ:TSLA): Evercore ISI expressed caution on Tesla, citing a "long-term negative EPS revision trend," concerns about autonomous vehicle rollout, and "divisive political posting."

Crypto-linked stocks (Circle Internet Group, Coinbase Global): Traded lower as "Trump-backed digital asset bills" failed to clear a procedural hurdle in Congress. Bitcoin also slipped below $117,000.

B. Analysis of Main Economic Factors Driving Market Changes

Inflation Concerns:U.S. consumer prices grew at a "faster-than-anticipated annualized pace in June, with the Labor Department’s headline consumer price index coming in at 2.7% in the twelve months to June". This was higher than May's 2.4% and expectations of 2.6%.

Month-on-month, the CPI was 0.3%, up from 0.1% in May.

Core CPI (excluding food and fuel) grew 2.9% year-over-year, slightly below the 3.0% expected, and 0.2% monthly, also below forecasts.

The inflation print "spurred fears about the impact of President Donald Trump's tariffs." Matthew Ryan of Ebury stated, "The latest U.S. inflation report practically confirmed that President Trump's tariffs acted to push up consumer prices in June."

Skyler Weinand of Regan Capital noted, "it's highly likely that a tariff-driven inflation reckoning is coming."

Federal Reserve and Interest Rates:Sticky inflation is "likely to keep the central bank from cutting interest rates in the near-term," according to the Federal Reserve.

President Donald Trump reiterated his demand for the Federal Reserve to lower interest rates, stating, "Consumer Prices LOW. Bring down the Fed Rate, NOW!!!" and calling for a "3 percentage point reduction."

Corporate Earnings:The second-quarter earnings season has begun, with banks leading the way. Many major U.S. lenders delivered "mixed quarterly earnings".

Expectations for earnings growth are low, with the S&P 500 projected to post a blended earnings growth rate of 4.3% year-over-year, which "would be mark the lowest growth rate for the index going back to the fourth quarter of 2023."

Manufacturing Activity:The New York Fed's Empire State Manufacturing index "jumped to 5.5, a nearly 22-point improvement over the prior month and much better than the -9.5 forecast," indicating an improvement in factory activity in the New York area.

C. Geopolitical Events Affecting Financial Markets

Trade Tensions and Tariffs:Trump announced an "early-stage trade deal with Indonesia that includes a 19% levy on the latter’s exports to the U.S."

Concerns persist regarding the impact of tariffs, with President Trump's Saturday announcement of a "30% tariff on goods from the European Union and Mexico starting Aug. 1" amplifying fears of further inflationary pressures. Analysts at CIBC Economics stated, "The passthrough of tariffs continues to be modest given businesses stocking up on pre-tariff inventories in addition to absorbing some of the costs in margins. However, those inventories are becoming thinner and we expect to see tariff passthrough ahead, which will keep the Fed on the sidelines for now."

U.S.-China Trade Relations:There has been an "improvement in U.S.-China trade relations, after Washington recently lifted several chip technology export restrictions against China." This development facilitated Nvidia's decision to resume H20 chip sales to China.

D. Forward-Looking Insights and What Investors Should Watch

Ongoing Earnings Season: Investors will continue to "wade through earnings from a host of big U.S. lenders" and other major companies this week, including Microsoft, Johnson & Johnson, United Airlines, Netflix, American Express, and 3M Company. These reports will provide further insights into corporate performance against the backdrop of rising trade tensions.

Inflation and Federal Reserve Policy: The trajectory of inflation and the Federal Reserve's response remain critical. The expectation is that "sticky inflation likely to keep the central bank from cutting interest rates in the near-term." Any further tariff announcements could exacerbate inflationary pressures, impacting the Fed's stance.

Trade Policy Developments: Further developments on the tariff front, especially concerning the EU and Mexico, will be closely monitored for their potential impact on domestic prices and global trade.

S&P 500's Technical Indicators: The S&P 500 has maintained a long streak above its 20-day moving average, signalling a bullish long-term trend. However, BTIG suggests a near-term pullback is likely, with a "test of ~6144 as we head into the back-half of July and likely something closer to the 6k level heading into August."

AI Infrastructure Investment: Significant investments in AI infrastructure, such as Google's $25 billion commitment and BlackRock's CEO Larry Fink calling the AI infrastructure opportunity "enormous," highlight a key growth area for investors.

Eco to watch:

Source: Trading Economics

Today Signal PnL feedback: 50/50 short, may set for tight stop loss again before the new future

Entry price reference: 17.34 or higher (spread 2.14 or lower)

UX1 Indicative range : Low - High (Jul) 17.1 - 17.78 (spread 1.96 - 2.24)

Stop loss: 17.7 30 mins after US open (or 18.2 hard stop and spread out as well)

Profit take: 17 any time thru out the day (include spr)

TP 17 was touched in early AP session and spread out 2.3 as NVDA able to resume H20

Move and PnL (**excl commission and slippage**)

25-07-15 cl : Short VIX (TP 17)+ Long Spread (TP 1.9) , UX1 -0.34, UX1UX2 +0.16 MTD net -($260) pnl

25-07-14 cl : Short VIX (SL 17.7)+ Long Spread (SL 1.9) , UX1 +0.58 , UX1UX2 -0.17 MTD net -($760) pnl

25-07-11 cl : Short VIX (SL 17.5)+ Long Spread (SL 1.95) , UX1 +0.63 , UX1UX2 -0.29, MTD net -($10) pnl

25-07-10 cl : Short VIX (TP 17)+ Long Spread (TP 2.25) , UX1 -0.08 , UX1UX2 +0.07, MTD net +$910 pnl

25-07-09 cl : Short VIX (TP 17.6)+ Long Spread (TP 1.9) , UX1 -0.42 , UX1UX2 +0.1 , MTD net +$760 pnl

25-07-08 cl : No positions, MTD net +$240 pnl

25-07-07 cl : Short VIX (SL 19)+ Long Spread, UX1 +0.6 , UX1UX2 -0.21 , MTD net +$240 pnl

25-07-03 cl : Short VIX (TP 18)+ Long Spread, UX1 -0.56 , UX1UX2 +0.1 , MTD net +$1,050 pnl

25-07-02 cl : Long VIX (TP 18.85), UX1 +0.20, MTD net $390 pnl

25-07-01 cl : Long VIX (TP 18.9), UX1 +0.19, MTD net $190 pnl

**Accum model

2025 YTD net +$9,460 pnl

2024 FY net +$40,005 pnl

2023 H2 net +$10,690 pnl

** multiplier USD$1000, assume 1 contract size (i.e. Short = -1 UX1, Long spr = -1 UX1 & 1 UX2, Long Vix = +1 UX1, No Action means no Positions). Margin indicative consumption: USD$22,000 for short or long + USD$10,000 for long spr = USD$32,000**

//Model signal apply from today US MARKET EOD GMT 4pm to next US MARKET EOD GMT 4pm for VIX future positions///

View this at your own risk. Historical performance does not serve as a dependable predictor of future performance. Material in this page comes from many sources and may be inaccurate or incomplete. This page does not warrant the completeness, accuracy or timing of any information herein. This is not an offer to buy or sell securities. Information or opinions on this page are presented solely for educational and entertainment purposes, and are not intended nor should they be construed as investment advice.

To plan ahead~~

16 Jul 2025 (Wed) Action SIGNAL :

SHORT VIX + LONG SPREAD

Vixbot Signal comment: Aug Future now, still 50/50 signal on short.. expect volatily during major earnings coming up.

Entry price reference: (Aug) 19.39 or higher (spread 1.3 or lower)

UX1 Indicative range : Low - High (Aug) 19.08 - 19.59 (spread 1.31 - 1.32)

Stop loss: 19.7 30 mins after US open (or 20.3 hard stop and spread out as well)

Profit take: 19.2 any time thru out the day (include spr)

17 Jul 2025 (Thu) Action SIGNAL : LONG VIX

Vixbot Signal comment: Very strong Long VIX is back, seems July seasonal impact is here

Some facts sharing, if we going back to a 20-30 VIX spot range, then expect ES to have a +/- 3% to 4% move. This align with the EMA average True Range as % to ES as well.