2025-07-14 (Mon) Market close

this is generated by AI via multiple sources, please treat this botcast as educational & entertainment purpose

Stocks higher on Monday as losses were kept in check as investors bet those duties will eventually be negotiated down and looked ahead to a busy week for second-quarter earnings season

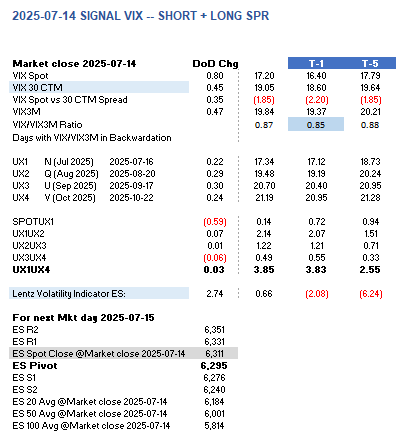

VIX term structure also reflected the same with more intra-day noise with slight up.CPI is still a focus but suspect less impactful

Source: Finviz

The market today exhibits cautious optimism. While US stock indices ended Monday slightly higher, persistent concerns over President Trump's tariff policies and upcoming economic data, particularly inflation readings, are keeping investors on edge. There is a prevailing hope that proposed tariffs will be negotiated down.

A. Key Market Movements and Trends from Today's Trading:

Overall Market Performance: Major US stock averages closed in positive territory on Monday.

The S&P 500 gained 0.14% to finish at 6,268.56.

The Nasdaq Composite rose 0.27% to settle at 20,640.33.

The Dow Jones Industrial Average increased by 0.20%, adding 88.14 points, to close at 44,459.65.

This follows a negative week for stocks, though the major averages remain "near record highs."

Sector-Specific Movements:

Healthcare: Oscar Health was downgraded by Piper Sandler to neutral from overweight, as the firm believes "solid CY25 execution is an insufficient catalyst to buoy the stock as time advances towards CY26." The stock has fallen about 33% in July after surging over 60% in Q2.

Technology: MicroStrategy's price target was lifted by TD Cowen to $680 from $590, citing surging Bitcoin prices and the company's "cost of capital advantage" in acquiring the cryptocurrency. MicroStrategy shares were up 3% on Monday and 54% year-to-date.

Retail: Burlington Stores saw a bullish outlook from UBS, with a reiterated buy rating and a $390 price target, implying 56% upside. The "Burlington 2.0" strategy is working, driving incremental earnings growth and improved customer loyalty. Best Buy was downgraded by Piper Sandler to neutral from overweight due to "lacking catalysts" and long-term competitor concerns in appliances and TVs.

Food & Beverage: McDonald's was initiated with a sell rating by Melius Research, citing eroded US value perception, intensifying competition, and a consumer shift towards healthier meals. Melius prefers Yum! Brands and Texas Roadhouse.

Cybersecurity: CrowdStrike was downgraded by Morgan Stanley to equal-weight from overweight, despite being a "compelling long-term story," due to "full valuation after ~50% run and rising growth expectations."

Individual Stock Movers (Midday/Premarket):

Autodesk: Rose over 5% on news of ending a potential acquisition plan for PTC.

PayPal: Jumped over 3% as analysts dismissed concerns about JPMorgan charging fees for customer bank account information.

Waters: Fell nearly 12% after announcing a merger with Becton Dickinson's Biosciences & Diagnostic Solutions unit.

Kenvue: Gained 4.5% after its CEO stepped down and the company announced a strategic review.

nCino: Rose nearly 5% following an upgrade at Baird.

Rivian Automotive: Pulled back 1.3% after Guggenheim downgraded it to neutral, citing likely softer long-term sales of its R2 and R3 vehicles.

Cryptocurrency: Bitcoin continued its rally, topping "$120,000 for the first time" on Monday, trading at $122,150.30, up 2.5% for the day and 30.4% year-to-date. This surge is driven by inflows into Bitcoin ETFs.

Asian-Pacific Markets: Closed mixed on Monday. Hong Kong's Hang Seng Index and South Korea's Kospi index saw gains, while Japan's Nikkei 225 and Australia's S&P/ASX 200 ended lower.

B. Analysis of the Main Economic Factors Driving Market Changes:

Tariff Policies: President Trump's recent announcements of new, steep tariffs are a significant driver of market uncertainty.

On Saturday, Trump announced a 30% tariff on the European Union and Mexico, effective August 1. This follows recent letters establishing new U.S. tariff rates on other countries like Japan, South Korea, and Canada (35% on Canada, 25% on South Korea and Japan, and a 50% levy on copper).

Investors are "monitoring ongoing updates on the tariff front," with "losses kept in check as investors bet those duties will eventually be negotiated down."

There is a "hope that Washington will agree to lower its proposed tariffs."

The EU has accused the US of resisting trade agreement efforts and "warned of retaliatory measures if Trump proceeds with his tariffs," with reports suggesting the EU is preparing to tariff 72 billion euros ($84 billion) worth of American goods.

Inflation Readings: Consumer Price Index (CPI) inflation data for June is due on Tuesday.

This data will provide "a better sense of how the Trump tariffs already in effect are being felt throughout the economy."

Markets are watching for a rise in both headline and core CPI, with "bets that Trump’s tariffs will be inflationary."

Federal Reserve Policy: The rift between the Trump administration and the Federal Reserve, particularly regarding interest rates, is a factor.

Bank of America suggests that recent Trump tariff developments "likely make it more difficult for the Fed to cut rates."

Economist Claudio Irigoyen stated that "With more uncertainty around the tariff shock and inflation, the Fed is less likely to cut rates at the margin."

While most Fed officials anticipate rate cuts in 2025, the "stagflationary risks" associated with tariffs could lead the Fed to "wait" before making cuts. Trump has also repeatedly criticised Fed Chair Jerome Powell for not lowering interest rates.

Corporate Earnings Season: A busy week for second-quarter earnings reports is underway, starting Tuesday.

Major banks, including JPMorgan Chase, Wells Fargo, Citigroup, Bank of America, Goldman Sachs, and Morgan Stanley, are reporting.

Other notable companies include Johnson & Johnson, United Airlines, PepsiCo, Netflix, American Express, and 3M Company.

"The big question for markets in the coming weeks is if earnings, which are expected to be solid, can overshadow the tariff issues that are still there in the background," said Glen Smith of GDS Wealth Management.

Paul Hickey of Bespoke Investment Group suggested a "moderate sell-off with the initial batch of earnings results wouldn't be surprising at all," given "a pretty high bar for earnings set."

C. Geopolitical Events Affecting Financial Markets:

US-EU-Mexico Trade Tensions: The primary geopolitical event impacting markets is President Trump's unilateral imposition of new tariffs on the European Union and Mexico, with a 30% tariff effective August 1. This "continues the trend of Trump releasing letters announcing tariff rates unilaterally, and hits two of the United States' biggest trading partners."

Global Trade Negotiations: Leaders from the EU and Mexico have indicated intentions to "keep talking with the Trump administration this month in an attempt to agree on a lower rate," suggesting ongoing negotiations are crucial for market stability.

D. Forward-Looking Insights and What Investors Should Watch:

Tariff Negotiations: The ongoing discussions between the US, EU, and Mexico regarding the proposed tariffs will be a critical watch point. Any indication of de-escalation or agreement on lower rates could positively impact market sentiment.

Second-Quarter Earnings Reports: The slew of earnings reports this week, particularly from major banks and other large corporations, will provide vital insights into corporate health and whether tariffs are impacting profitability. Investors will assess if "earnings, which are expected to be solid, can overshadow the tariff issues."

Inflation Data (CPI): The June CPI data, due on Tuesday, will be closely scrutinised for signs of inflation, which could influence the Federal Reserve's stance on interest rates.

Federal Reserve Commentary: Any statements or indications from Federal Reserve officials regarding interest rate policy will be closely watched, especially in light of potential inflationary pressures from tariffs.

Company-Specific Developments: Investors should monitor company-specific news, particularly those receiving analyst upgrades or downgrades, or those involved in significant corporate actions like mergers or leadership changes.

Eco to watch:

Source: Trading Economics

Today Signal PnL feedback: Still try to keep up the Vol crush phrase, however as getting close to expiry. Dont put too much risk

Entry price reference: 17.12 or higher (spread 2.07 or lower)

UX1 Indicative range : Low - High (Jul) 16.58 - 17.61 (spread 1.89 - 2.27)

Stop loss: 17.4 30 mins after US open (or 17.7 hard stop and spread out as well)

Profit take: 16.6 any time thru out the day

Hard SL 17.7 was touched in early AP session and spread out 1.9.

Move and PnL (**excl commission and slippage**)

25-07-14 cl : Short VIX (SL 17.7)+ Long Spread (SL 1.9) , UX1 +0.58 , UX1UX2 -0.17 MTD net -($760) pnl

25-07-11 cl : Short VIX (SL 17.5)+ Long Spread (SL 1.95) , UX1 +0.63 , UX1UX2 -0.29, MTD net -($10) pnl

25-07-10 cl : Short VIX (TP 17)+ Long Spread (TP 2.25) , UX1 -0.08 , UX1UX2 +0.07, MTD net +$910 pnl

25-07-09 cl : Short VIX (TP 17.6)+ Long Spread (TP 1.9) , UX1 -0.42 , UX1UX2 +0.1 , MTD net +$760 pnl

25-07-08 cl : No positions, MTD net +$240 pnl

25-07-07 cl : Short VIX (SL 19)+ Long Spread, UX1 +0.6 , UX1UX2 -0.21 , MTD net +$240 pnl

25-07-03 cl : Short VIX (TP 18)+ Long Spread, UX1 -0.56 , UX1UX2 +0.1 , MTD net +$1,050 pnl

25-07-02 cl : Long VIX (TP 18.85), UX1 +0.20, MTD net $390 pnl

25-07-01 cl : Long VIX (TP 18.9), UX1 +0.19, MTD net $190 pnl

**Accum model

2025 YTD net +$8,960 pnl

2024 FY net +$40,005 pnl

2023 H2 net +$10,690 pnl

** multiplier USD$1000, assume 1 contract size (i.e. Short = -1 UX1, Long spr = -1 UX1 & 1 UX2, Long Vix = +1 UX1, No Action means no Positions). Margin indicative consumption: USD$22,000 for short or long + USD$10,000 for long spr = USD$32,000**

//Model signal apply from today US MARKET EOD GMT 4pm to next US MARKET EOD GMT 4pm for VIX future positions///

View this at your own risk. Historical performance does not serve as a dependable predictor of future performance. Material in this page comes from many sources and may be inaccurate or incomplete. This page does not warrant the completeness, accuracy or timing of any information herein. This is not an offer to buy or sell securities. Information or opinions on this page are presented solely for educational and entertainment purposes, and are not intended nor should they be construed as investment advice.

To plan ahead~~

15 Jul 2025 (Tue) Action SIGNAL :

SHORT VIX + LONG SPREAD

Vixbot Signal comment: 50/50 short, may set for tight stop loss again before the new future

Entry price reference: 17.34 or higher (spread 2.14 or lower)

UX1 Indicative range : Low - High (Jul) 17.1 - 17.78 (spread 1.96 - 2.24)

Stop loss: 17.7 30 mins after US open (or 18.2 hard stop and spread out as well)

Profit take: 17 any time thru out the day (include spr)

16 Jul 2025 (Wed) Action SIGNAL : SHORT VIX + LONG SPREAD

Vixbot Signal comment: Aug Future now, still 50/50 signal on short.. expect volatily during major earnings coming up

Some facts sharing, if we going back to a 20-30 VIX spot range, then expect ES to have a +/- 3% to 4% move. This align with the EMA average True Range as % to ES as well.