2025-04-15 (Tue) Market close

this is generated by AI via multiple sources, please treat this botcast as educational & entertainment purpose

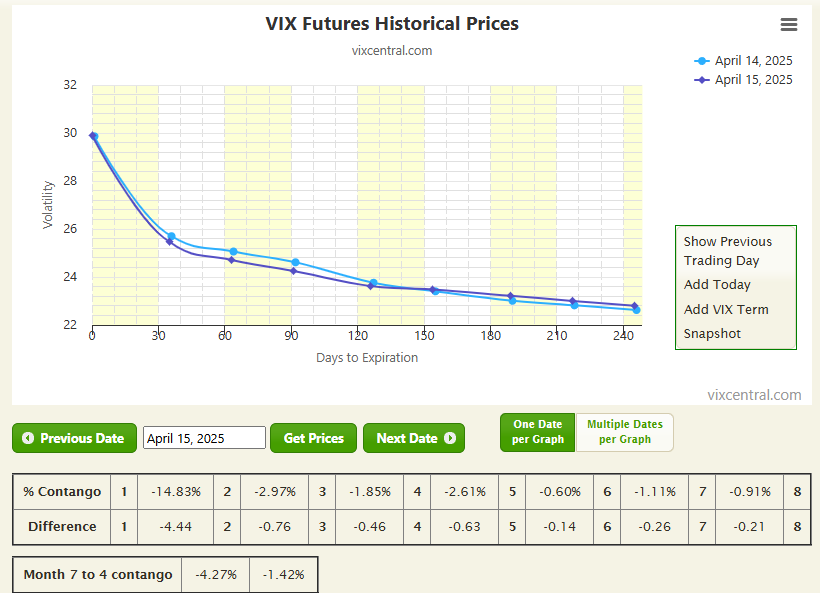

Market is still hovering on the volatilty of Tariff’s “unknown” news and impact, back end was flatten a bit but still hvae a high backwardation. Let see how post expiry goes.

Source: finviz.com

Marginal Losses Amid Tariff Uncertainty: The major US indices closed slightly lower on Tuesday. The Dow Jones Industrial Average fell by 0.38%, the S&P 500 declined by 0.17%, and the Nasdaq Composite edged down by 0.05%. This follows a period of heightened volatility driven by President Trump's earlier tariff announcements. As Larry Tentarelli of the Blue Chip Daily Trend Report noted, "the worst-case scenario is off the table," but the market remains susceptible to negative trade headlines, with the potential for significant downward movements.

Easing Volatility but Caution Remains: The CBOE Volatility Index (VIX) continued its descent, falling to around 30 after peaking near 60 last week. This suggests a decrease in immediate market fear. However, analysts at Piper Sandler believe the market is "not out of the woods yet" regarding tariff volatility and would like to see the S&P 500 recover further before declaring a definitive end to the recent turbulence. They anticipate investors will temporarily focus on earnings, allowing the "macro picture to settle down in the upcoming weeks."

Sector Performance Mixed; Banks Shine: Bank stocks demonstrated strong performance, providing upward momentum to the market. Bank of America and Citigroup both exceeded analyst expectations for the first quarter, with their shares rising by 3.6% and 1.8% respectively. The SPDR S&P Bank ETF (KBE) also rose by more than 1%. Conversely, healthcare stocks faced pressure, dragging on the S&P 500. Molina Healthcare, Zimmer Biomet, and Moderna were among the significant decliners in the sector.

Earnings Season in Focus: Investors are actively analyzing first-quarter earnings reports. Positive results from banks like Bank of America and Citigroup provided some support. Looking ahead, major reports are due from companies such as United Airlines and Netflix. Josh Brown of Ritholtz Wealth Management expressed confidence in Netflix, stating, "I actually think it’s the best stock in the market for this year," citing its resilience in a potentially defensive market.

Boeing Under Pressure Due to China Order: Shares of Boeing experienced a decline of over 2% following a report that Beijing has instructed Chinese airlines to halt further Boeing plane deliveries and suspend purchases of aircraft equipment from US companies.

Tariff Exemptions and Lingering Uncertainty: Recent guidance from US Customs and Border Protection revealed temporary exemptions for electronic products from "reciprocal" tariffs, providing a "tailwind" to stocks earlier in the week. However, comments from President Trump and Commerce Secretary Howard Lutnick suggest these exemptions may not be permanent, contributing to ongoing uncertainty. Despite recent gains, major indexes are still recovering from losses incurred after the initial tariff announcements in early April.

Divergent Views on Market Direction: Market analysts hold differing opinions on the near-term outlook. Ken Mahoney of Mahoney Asset Management suggests that "big money may be looking to sell all rallies, as we still overall are in bearish conditions," anticipating a test of the recent rally. In contrast, BMO Wealth Management's chief investment officer believes the underlying economic fundamentals remain relatively solid, expecting consumer spending to hold up and the labor market to remain healthy.

Gold Miners Surge Amid Uncertainty: The VanEck Gold Miners ETF (GLD) reached its highest level since 2012, driven by a surge in gold prices. This increase is attributed to heightened safe-haven demand stemming from the market uncertainty sparked by Trump's tariff policies.

Potential Shift in Corporate Tax Policy: White House press secretary Karoline Leavitt indicated that President Trump might be open to raising the corporate tax rate as part of broader tax policy negotiations, with the Tax Cuts and Jobs Act set to expire at the end of the year.

Jamie Dimon Calls for US-China Engagement: JPMorgan Chase CEO Jamie Dimon urged the White House to initiate negotiations with China to prevent further escalation of trade tensions, particularly after China's retaliatory tariffs on US goods. He cautioned against assuming continued success without addressing these issues.

Wolfe Research Predicts Near-Term Downside: Wolfe Research maintains a view that "the near-term trend is to the downside," despite believing "peak fear" related to the initial tariff announcements has passed. They anticipate continued market sensitivity to trade policy updates during the 90-day pause on some levies.

Elliott Management Takes Stake in HP Enterprise: Shares of Hewlett Packard Enterprise jumped after news that Elliott Management acquired a $1.5 billion stake in the company, aiming to engage in discussions to enhance shareholder value.

Bank of America Downgrades Dow Inc.: Bank of America issued a rare double-downgrade on Dow Inc., citing a "perfect storm" of a softening macro environment, emerging trade barriers, and increased US feedstock costs.

Import Prices Fell Before Tariffs: Data released Tuesday showed that US import prices edged lower in March, prior to the implementation of President Trump's broad tariffs.

Empire State Manufacturing Mixed: The New York Fed's Empire State Manufacturing index showed a better-than-expected improvement in current conditions but a significant decline in the outlook for future activity.

Nvidia Warning Spooks Tech Sector (Post-Market): Following the official market close, Nvidia reported that new US government restrictions on exports to China would result in a substantial revenue hit. This announcement triggered significant declines in Nvidia's stock price in after-hours trading and negatively impacted other chipmakers and technology stocks, highlighting the ongoing sensitivity to US-China trade dynamics, particularly in the tech sector.

Stocks Pressured by Tariff-Induced Slowdown Fears: This source explicitly highlights fears that US tariffs will weaken economic growth and corporate earnings as a key pressure on stocks over the past five weeks. It details the timeline of tariff implementations and retaliatory measures between the US and China, noting the resulting pressure on the US dollar and boost to gold prices, indicative of market concerns about the economic consequences of these policies. The source also mentions the EU's delay in implementing retaliatory tariffs, suggesting a broader global impact of the US trade actions.

Upcoming Economic Data and Fed Commentary: The market is anticipating upcoming US economic data, including retail sales and industrial production figures, as well as a speech by Federal Reserve Chair Jerome Powell, for further insights into the economic outlook and potential policy responses.

Eco to watch:

Source: Trading Economics

Today Signal PnL feedback: NO POSITION as now VIX back above 35

Entry price reference: NA

UX1 Indicative range : Low - High 27.23 - 32.38 (spread -5.3 - -2.97)

Stop loss: NA

Profit take: NA

No positions